Calculate self employment tax deduction

What is my tax-equivalent yield. You are responsible for federal and state if applicable taxes on your adjusted gross incomeSo the more tax deductions you can find the more money youll keep in your pocket.

Llc Tax Calculator Definitive Small Business Tax Estimator

To file yearly taxes youll need a Schedule Cform.

. Risk of a Large Increase in Self-Employment Taxes. How much of my social security benefit may be taxed. In the real world the critical issue for the tax authorities is not whether a person is engaged in a business activity called.

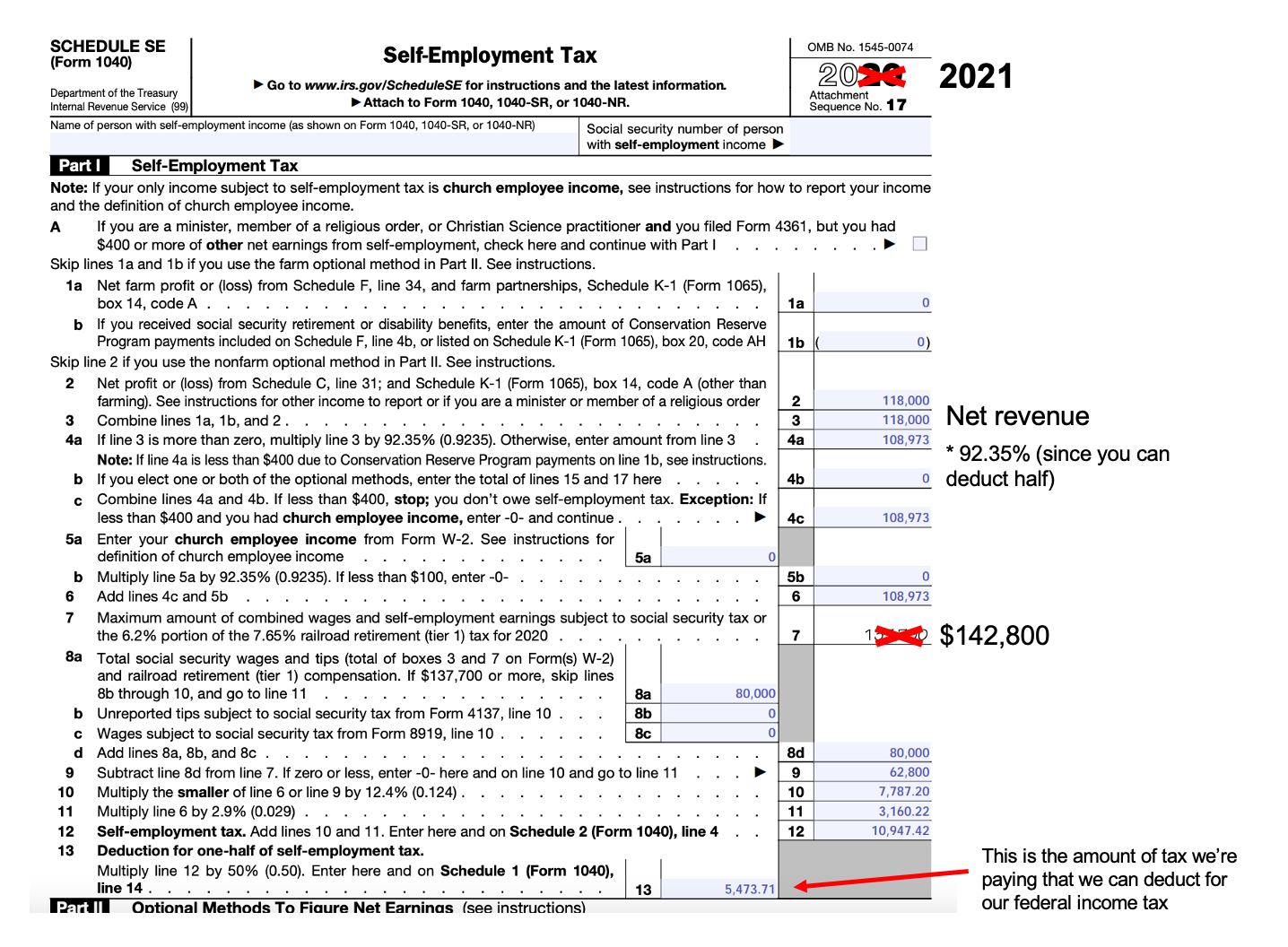

This deduction is taken into account in calculating net earnings from self-employment. Self-employment tax Lines 1a and b are special lines about farming income that you dont have to worry about unless youre a farmer. For example say you paid 12000 for your health insurance coverage for the year and the net profit from your sole proprietorship was 20000.

Actual results will vary based on your tax situation. As a self-employed individual you are generally responsible for estimated quarterly tax payments and an annual return. SE tax deduction.

The Internal Revenue Service requires anyone making 400 or more in self-employment income to file a tax return. Its worth up to 20 of their income after subtracting business write-offs. You can deduct one half of your self-employment taxes on your tax return.

One available deduction is half of the Social Security and Medicare taxes. President-elect Joe Biden suggested that in addition to increasing marginal tax rates on corporations and high income earners he would remove the cap on FICA taxes for those earning above 400000 in income. Filing an annual return.

He would treat any income above that level similarly to the first 137700 and have it fully exposed to FICA taxes. Who Must Pay Self-Employment Tax. For 2020 the FICA limit is on the first 137700 of income.

Reporting Self-Employment Tax. When figuring your adjusted gross income on Form 1040 or Form 1040-SR you can deduct one-half of the self-employment tax. Self-Employment Tax to calculate how much self-employment tax you should have paid throughout the year.

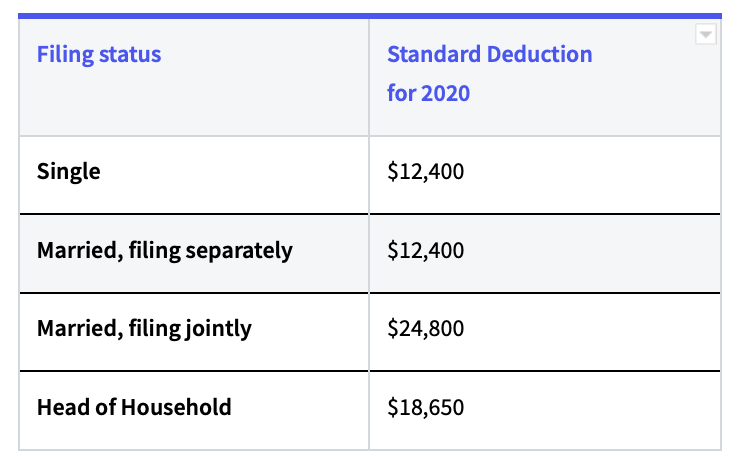

Should I itemize or take the standard deduction. You calculate the home office deduction first on Form 8829. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed.

You calculate this deduction on Schedule SE attach Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF. Step one when looking to reduce self employment taxes is taking all above the line deductions. There is an additional Medicare tax of 9 for self-employed taxpayers who have a total earned income of more than 200000 250000 if married filing jointly or 125000 if married filing separately.

Compute self-employment tax on Schedule SE Form 1040. Self-employment is the state of working for oneself rather than an employer. The 2000 lowers your overall taxable income just like the standard deduction does.

In other words if your business doesnt earn a profit you cant take the deduction. Lines 2-4c will ask you to take your total net self-employment income and multiply it by 9235 to calculate your net earnings which is the part of your income that is subject to self. How much self-employment tax will I pay.

Self-employed people pay self-employment taxes which had them paying both halves of the tax. Deductions To Reduce Self Employment Taxes. Capital gains losses tax estimator.

See the Form 1040 or 1040-SR and Schedule SE instructions for calculating and claiming the deduction. Self employment deduction - the easy one already included in your estimate above. The return must include a Schedule SE which you use to calculate how much self-employment tax you owe.

Expenses for Business Use of Your Home and then enter the result here. Below is a non-comprehensive list of the most important deductions to should consider. 2022 tax refund.

On his Presidential campaign Senator Joe Biden proposed also imposing the payroll tax on every dollar of income above 400000. Compare taxable tax-deferred and tax-free investment growth. However when you are filling out your 1040 the IRS allows you to deduct a portion of the self-employment tax.

Thats right the IRS considers the employer portion of the self-employment tax 765 as a deductible expense. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. Theres no dollar limit for the deduction but it is limited to your net profit from self-employment.

Unfortunately it has no effect on your self-employment taxes only your income taxes. If you file a joint return with another self. Here are some additional taxes for small business owners.

You must pay self-employment tax and file Schedule SE Form 1040 or 1040-SR if either of the following applies. The qualified business income deduction gives anyone with self-employment income a bonus write-off. What are the tax implications of paying interest.

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

Self Employed Health Insurance Deduction Healthinsurance Org

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Self Employment Calculator Youtube

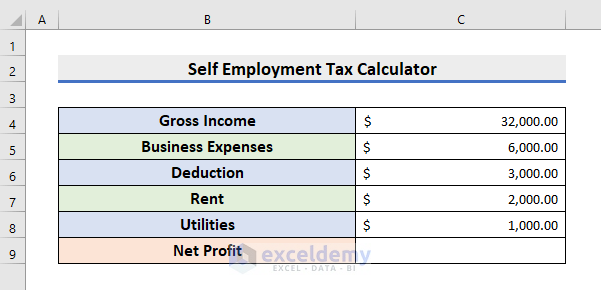

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

14 Tax Tips For The Self Employed Taxact Blog

A Guide To Taxes For The Self Employed And Independent Contractors

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Schedule C Income Mortgagemark Com

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Calculate Self Employment Tax In The U S With Pictures

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Pay Less Tax On Self Employment Income Millennial Money With Katie

How To Calculate Self Employment Tax In The U S With Pictures